st louis county personal property tax waiver

Monday - Friday 8 AM - 500 PM NW Crossings South County. A waiver or statement of non-assessment is obtained from the county or City of St.

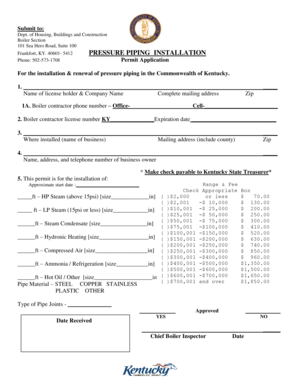

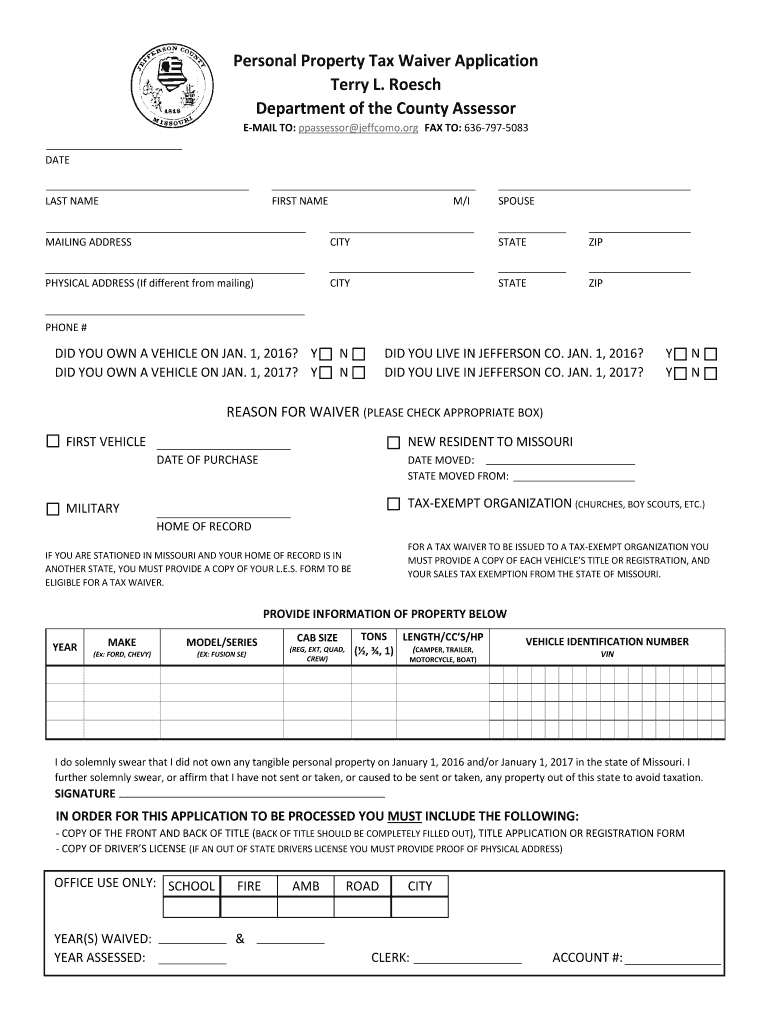

Personal Property Tax Waiver Jefferson County Mo Fill Out Sign Online Dochub

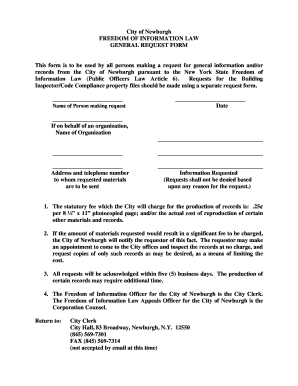

You moved to Missouri from out-of-state.

. A waiver or statement of non-assessment is obtained from the county or City of St. Obtain a Personal Property Tax Receipt Instructions for how to find City of St. Pin On Quotes Louis MO 63129 Check cash money order Check cash money order M F.

You will need to contact the. How do I pay my personal property tax in St Louis County. To declare your personal property declare online by April 1st or download the printable forms.

Louis collector if you did not own or have under your control any personal property as of January 1. St louis county personal property tax waiver. 41 South Central Avenue Clayton MO 63105.

What do I need for a personal property tax waiver. Monday - Friday 8AM - 430PM. You moved to Missouri from out-of-state.

Can somebody please explain how I need to go about declaring my personal property for St Louis county. Louis City assessors office says the total value of vehicles in the city followed that national increase of about 20 over last year. Online tax receipt can be used at the Missouri Department of Revenue license offices when licensing your vehicle.

41 South Central Clayton MO 63105. Ann MO 63074 Keller Plaza 4546 Lemay Ferry Rd. I have been living in the county since the first of the year and I thought I had it.

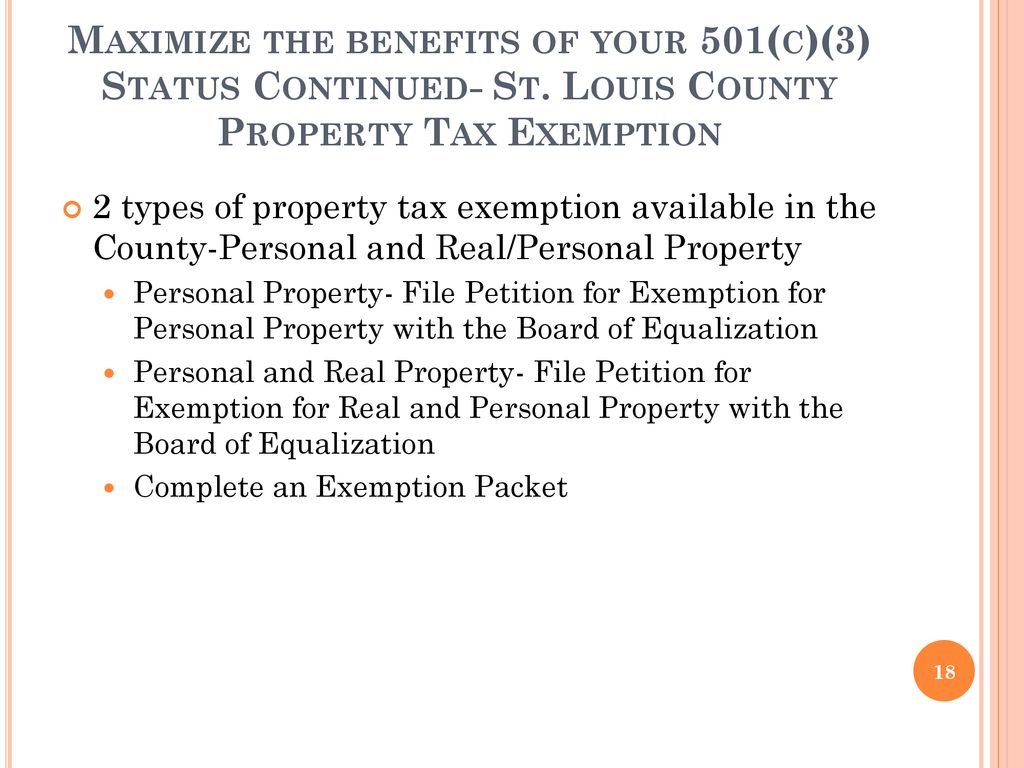

Louis Citys Assessor Michael Dauphin said the city saw a 23 increase in personal property values from 2021 to 2022. Louis officials estimated that if property values remained the same and. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years.

8am 430pm M F. Click the Begin Online button and enter your address or account number. 8am 430pm Services Offered.

We recommend visiting of our office to obtain the waiver. Monday - Friday 8 AM - 5 PM. Louis assessor if you did not own or possess personal property as of January 1.

You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years. Statement of Non-Assessment Tax Waiver If you are a new resident to the State of Missouri or did not own a motor vehicle on January 1st of the prior year you qualify for a tax waiver. How to Apply for a Tax Waiver Statement of Non-Assessment Front and back of the asset title person to person sale requires the.

Searching by Account Number is most reliable. Account Number number 700280. Louis MO 63129 Check cash money order Check cash money order M F.

1200 Market St Room 109 St. Account Number or Address. This is quite the jump from 2020 to 2021 which.

Statewide the State Tax.

Tracy James Legal Services Of Eastern Missouri Ppt Download

Collector Of Revenue Faqs St Louis County Website

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

News Flash St Charles County Mo Civicengage

Sheriff St Louis County Courts 21st Judicial Circuit

Print Tax Receipts St Louis County Website

Personal Property Tax Waiver Jefferson County Mo Fill Out Sign Online Dochub

The New York Times Talks Property Assessments In St Louis County Show Me Institute

Property Exemptions St Louis County Website

Stl City Assessor Assessorstl Twitter

How Do You Know If You Qualify For The Missouri Property Tax Credit

Fill Free Fillable Forms For The State Of Missouri

Certificate Of Non Assessment Tax Waiver St Charles County Mo Official Website

Whats The St Louis Park Mn Property Tax Rate Is It Worth Selling

County Assessor St Louis County Website

Personal Property Tax Waiver Jefferson County Mo Fill Out Sign Online Dochub