san antonio general sales tax rate

How do you figure out sales tax in San Antonio. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax.

The San Antonio Texas general sales tax rate is 625.

. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. This includes the rates on the state county city and special levels. City Sales and Use Tax.

In San Antonio for instance a business located in the central city collects the general city sales tax additional city taxes for venues and a municipal development corporation and taxes for. The sales tax jurisdiction. Texas Comptroller of Public Accounts.

The portion of the sales tax rate collected by San Antonio is 125 percent. The 78216 San Antonio Texas general sales tax rate is 825. The Texas sales tax rate is currently.

There is no applicable county tax. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The San Antonio Texas general sales tax rate is 625.

The minimum combined 2022 sales tax rate for San Antonio Texas is. Object moved to here. Every 2019 combined rates mentioned.

View the printable version of city rates. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax. The average cumulative sales tax rate in San Antonio Texas is 822.

Every 2018 combined rates. The current total local sales tax rate in San Antonio NM is 63750. The December 2020 total local sales tax rate was also 8250.

The December 2020 total local sales tax rate was also 63750. City sales and use tax codes and rates. The current total local sales tax rate in San Antonio TX is 8250.

The 78216 San Antonio Texas general sales tax rate is 825. The sales tax jurisdiction. The County sales tax.

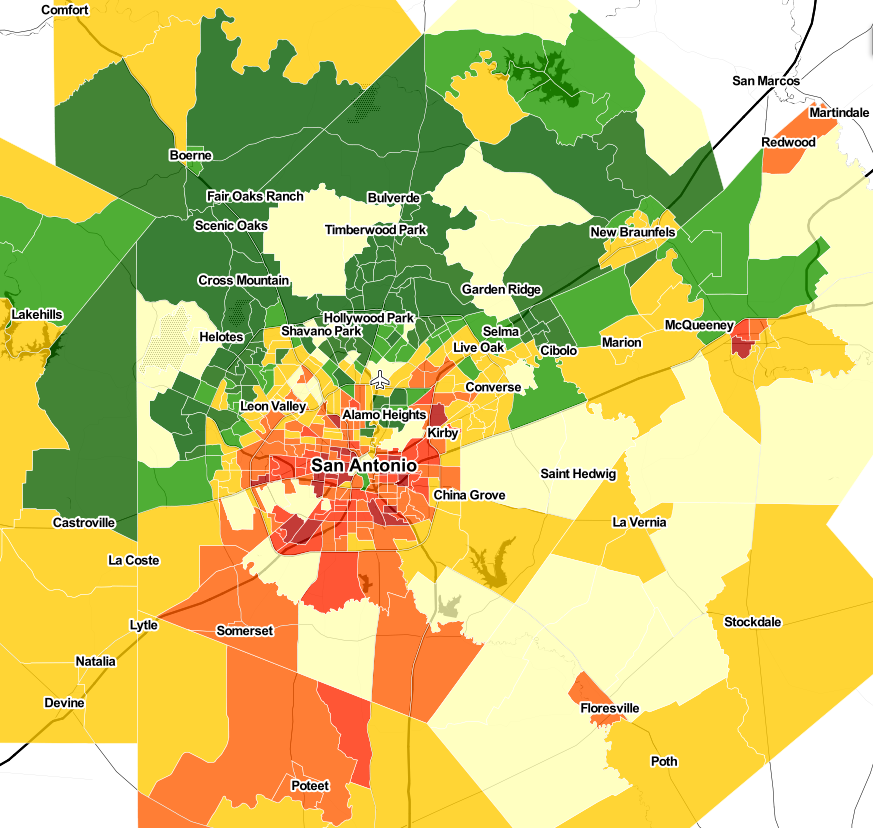

San Antonio has parts of it located within Bexar. Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825. This is the total of state county and city sales tax rates.

The San Antonio sales tax rate is 825. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

San Antonio City Council Provides Additional Property Tax Relief For Residents Kens5 Com

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

/https://static.texastribune.org/media/files/85e20dce251581d7db5bf518e23efd18/06_Abbott_State_of_the_State_MG.jpg)

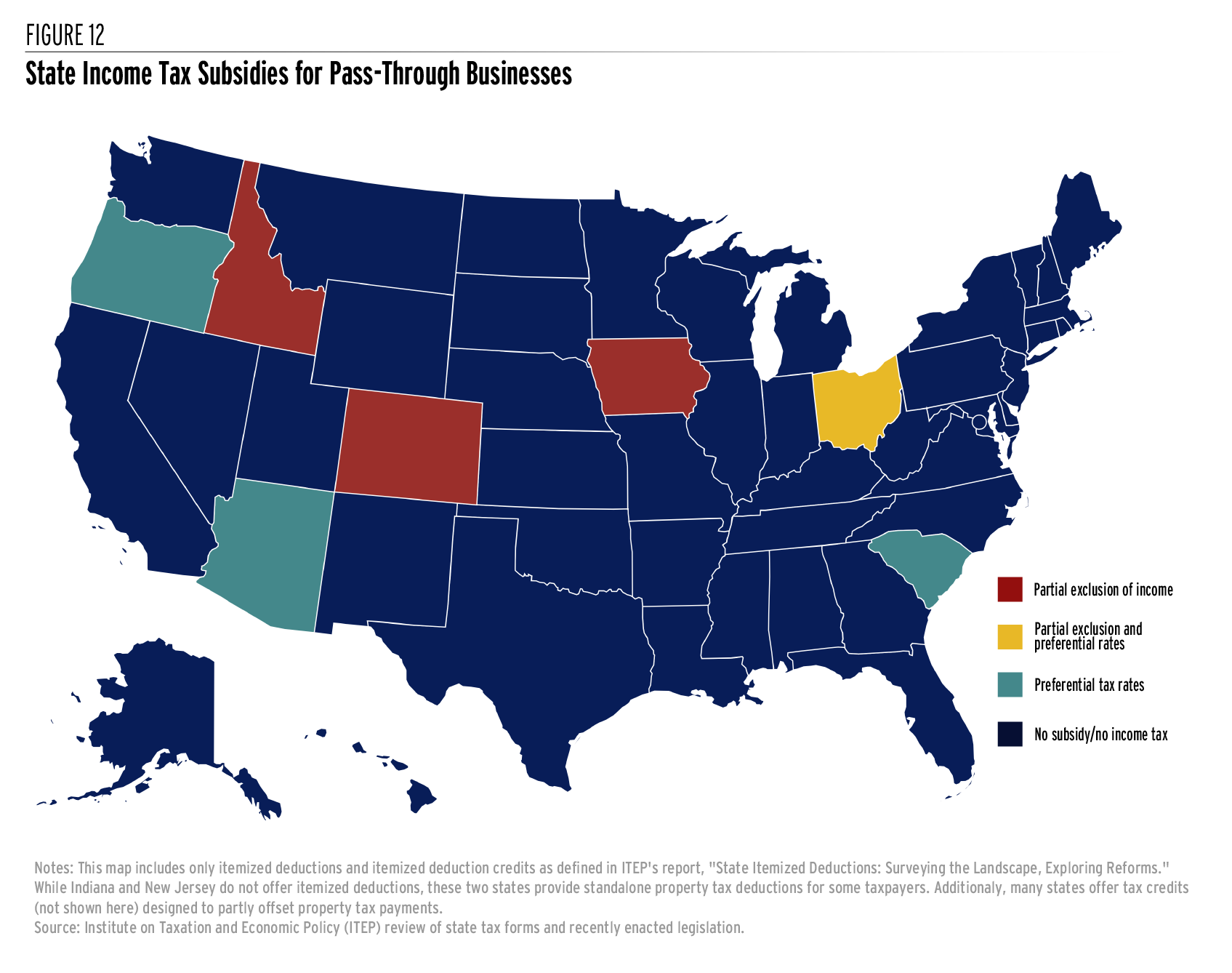

Texas Sales Tax Increase Would Hit Poor People The Hardest The Texas Tribune

Property Taxes By State Quicken Loans

San Antonio Real Estate Market Stats Trends For 2022

State And Local Sales Tax Rates In 2017 Tax Foundation

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

Understanding California S Sales Tax

Retail Trade Indicators Austin Chamber Of Commerce

Local Tax Rates And Exemptions 2018 Texas Cities San Antonio Report

/https://static.texastribune.org/media/files/2c80fe77f6e2a3c06be6bd8c4a7baeeb/06%20Glenn%20Hegar%20Biennial%20Revenue%20Estimate%20MG%20TT.jpg)

Texas Property Tax Cuts School Funding Raise Sustainability Questions The Texas Tribune

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

How To Charge Your Customers The Correct Sales Tax Rates

Latest Property Tax Sales In Texas Mvba

Tax Rates And Local Exemptions Across Texas San Antonio Report